Senate Republicans are finally marking up their tax reform plan. It’s still unclear what the details may be after lobbyists have had their say and the parochial interests of GOP senators are satisfied, but a few themes are becoming clear.

The corporate tax rate would be reduced from 35 percent to 20 percent (still much higher than President Donald Trump’s earlier promises of a 15 percent rate). There would be a one-time tax reduction of an unspecified amount for corporations that repatriate cash now held abroad to avoid being taxed. On the individual side, the numbers of both tax brackets and deductible expenses would be reduced, and the standard deduction increased.

“All this is well and good, except for a few little things,” said Libertarian National Committee Chair Nicholas Sarwark. “First, Republicans are trying to make their tax reform bill revenue neutral. That means for every tax reduction, there is a tax increase elsewhere. They will probably fail at that task, which is a good thing. Second, it doesn’t matter much whether the federal government borrows the money it spends or extracts it from the people through taxation. In either case, that money is no longer available to be spent or invested by individuals throughout the economy. It is instead spent destructively on wars, counterproductive bureaucracies, and transfers of wealth from workers to non-workers.”

Nearly 70 percent of federal spending falls under so-called “mandatory” categories, including Social Security and other pensions, health care, interest on the debt, and various income transfer programs. Research by Mercatus Center Senior Research Fellow Veronique de Rugy also shows that 43 percent of all federal spending is borrowed.

“This means that the government is already borrowing before it even thinks about discretionary spending for defense, courts, regulatory agencies, roads, etc.,” Sarwark said. “That’s all borrowed money.”

Even worse, Democrats led by Senate Minority Leader Chuck Schumer don’t want any tax cuts at all unless they get to write them. They engage in class warfare by claiming that GOP tax cuts benefit only the top 1 percent of income earners.

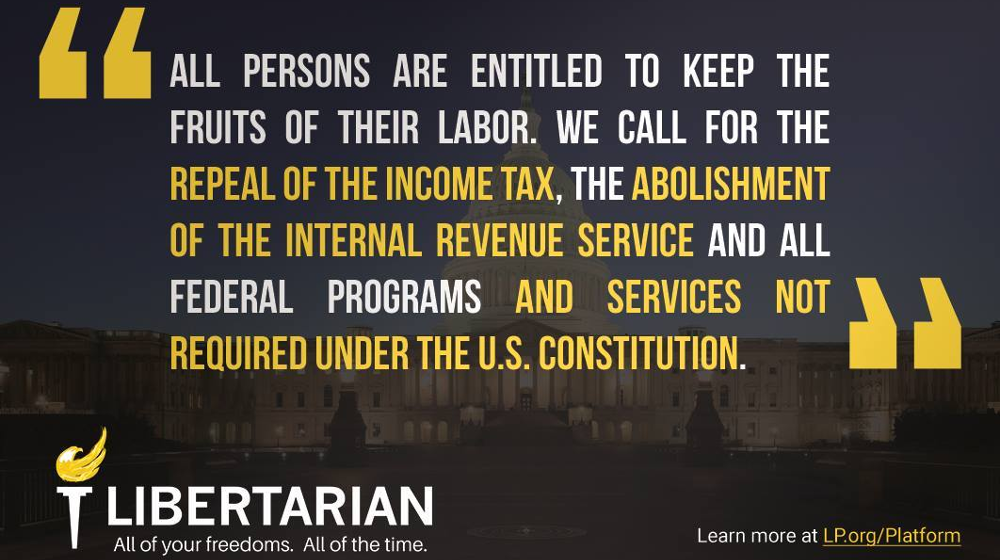

The common-sense Libertarian solution entails first slashing the 43 percent of federal spending that is borrowed: limit defense spending to actual defense, eliminate counterproductive regulatory bureaucracies, and phase out the government’s involvement in health care and pensions. Then cut spending even more, along with corresponding cuts in taxes.

The Bureau of Labor Statistics says Americans spend more on federal, state and local taxes than they do on food and clothing combined. People obtain real value in their food and clothing choices because they are able to purchase the things they want. They don’t get their money’s worth from government services.